Cash has certainly been king over the last few years. As the Federal Reserve raised rates to combat inflation, cash, money market funds, and CDs have been paying yields not seen in roughly a decade. Investors are earning real interest on their savings. And when you add in all the uncertainty about the economy, cash has become a real allocation for many investors.

But cash’s time in the sun may be setting as a variety of factors take hold.

But there is a safe alternative in short-term muni bonds. Right now, short-term munis are paying more than cash rates before any of their tax benefits kick in. Moreover, they feature equally high credit quality as cash and other short-term asset classes. For investors, the time to get out of money is now, and short-term munis could be the answer.

The Problem With Cash

Investors are sitting on cash to the tune of nearly $6.91 trillion. That’s according to the latest Investment Company Institute weekly cash report ending April 23. That’s about $32 billion more than the previous week. This doesn’t include savings, CDs, or other cash-like proxies.

It’s easy to see why investors have fallen in love with cash over the last few years. As inflation raged, the Federal Reserve underwent one of the most aggressive tightening schemes in history. This has pushed rates from zero during the pandemic up to 5.5%. As such, cash once again started to pay some serious interest. As a result, cash and cash-like investments could generate strong returns.

However, the appeal of cash may be waning.

It’s no secret that the economy is starting to face some nasty headwinds. Slowing growth, tariffs, and a shrinking labor and consumer market are starting to significantly impact data. The threat of recession is real. As such, the Fed has already begun cutting rates, and the latest FedWatch Tools predict a few more cuts this year.

For cash, this is a problem. With a duration of effectively zero, cash is the first asset class to feel any cuts and feels them severely. According to asset manager MFS, during past rate-cutting cycles, money market rates fell by 96% of the total interest rate decline. For example, from September 2007 to December 2008, money market yields fell from 4.3% to 0.9%. From July 2019 to March 2020, they plunged from 1.8% to 0.7%.

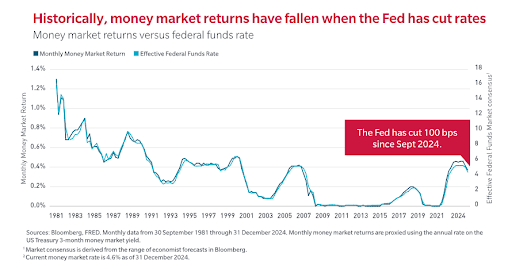

This chart from MFS highlights how money market rates move in lock-step with Fed policy.

Source: MFS

What’s interesting is the tail-end of the chart. As you can see, the Fed has already cut rates by 100 basis points since last year. That’s driven down yields on cash. And with the economy starting to get dicey amid new tariff threats and other economic points, recession risk is running high. That could drive the return on cash even lower.

Short-Term Munis To The Rescue

For investors who still want the safety of cash while earning a very competitive return, there is an option as cash yields drop. That answer could be in short-term municipal bonds.

Municipal bonds are issued by states and local governments to fund their operations. They tend to have very high investment-grade credit quality as taxes, states’ rainy-day funds, and revenues generated from various projects fund their repayment/coupons. As an added bonus, Uncle Sam is willing to cut municipal bond investors a tax break on that interest. Better still is that muni bonds are exempt from the issuing state’s taxes. So, an investor in California buying California-issued munis would pay effectively no taxes on the interest.

The key for cash investors is to focus on the short end of the curve, two years or less.

For starters, short-term bonds tend to have lower economic and market-induced volatility than other longer-term bonds. There’s less risk that investors won’t be paid back. This helps them on the returns front. The Bloomberg Municipal Short (1-5 Year) Index has managed to deliver positive returns in 24 of the past 25 years, with an average return of 2.67%.

Secondly, short-term bonds allow investors to reduce their duration risk if/when the Fed cuts. That’s because these bonds allow investors to “lock in” their yields for the next years or so. As cash and money market yields drop, investors in short-term munis will be able to keep their income high.

And speaking of that income, short-term munis now offer a real yield advantage over cash.

Right now, the Bloomberg Managed Money Municipal Short-Term Index features a yield-to-worst of 3.18%, which already surpasses rates on many FDIC savings options, CDs, and is attractive vs. T-bills. The kicker for investors is their tax-free nature. When accounting for taxes, that yield is a taxable equivalent yield of 5.12%. To get that sort of yield, investors would either need to take on additional credit risk, go out farther on the maturity ladder, exposing them to duration risk, or do both.

This gives short-term munis a very unique advantage over many other asset classes. Investors can maintain cash-like low-volatility, lock-in income to reduce duration risks, and still provide a very high yield.

Replacing Cash

Now, having some level of cash exposure with a money market does make sense for most investors. But those holding cash as an asset class or within an allocation model may finally want to go ahead and move out of that position. The risks to cash and rate cuts are too great. And with that, short-term munis make a ton of sense. By using them, investors can still maintain a strong credit profile, low volatility, and high yield.

Getting exposure is relatively easy as well. Thanks to the fixed-income ETF boom of the last few years, there are now numerous funds that track the sector, both passively and actively. By using one of these funds, adding the sector is quite easy. With an active fund, investors may be able to squeeze out a bit more yield as managers underweight/overweight different bonds relative to benchmarks.

Short-Term Municipal Bond ETFs

These funds are selected based on exposure to short-term munis, both VRDOs and those with maturities of less than two years. They are sorted by their YTD total return, which ranges from 0.9% to 3.7%. Their expense ratio ranges from 0.2% to 1.2%, while they have AUM between $28M and $9.1B. They are currently yielding between 2.2% and 3.4%.

| Ticker | Name | AUM | YTD Total Ret (%) | Yield (%) | Exp Ratio | Security Type | Actively Managed? |

|---|---|---|---|---|---|---|---|

| PVI | Invesco Floating Rate Municipal Income ETF | $28M | 1.2% | 2.2% | 0.25% | ETF | No |

| MEAR | BlackRock Short Maturity Municipal Bond ETF | $797M | 0.9% | 2.8% | 0.25% | ETF | Yes |

| JMST | JPMorgan Ultra-Short Municipal ETF | $3.44B | 0.8% | 3.1% | 0.18% | ETF | Yes |

| SMMU | PIMCO Short Term Municipal Bond Active ETF | $671M | 0.7% | 2.7% | 0.35% | ETF | Yes |

| TAFI | AB Tax-Aware Short Duration Municipal ETF | $681M | 0.6% | 3.4% | 0.27% | ETF | Yes |

| SUB | iShares Short-Term National Muni Bond ETF | $9.03B | 0.4% | 2.4% | 0.07% | ETF | No |

| CGSM | Capital Group Short Duration Municipal Income ETF | $611M | 0.4% | 3.2% | 0.25% | ETF | Yes |

| FSMB | First Trust Short Duration Managed Municipal ETF | $445M | 0.4% | 3.1% | 0.55% | ETF | Yes |

| SHM | SPDR Nuveen Bloomberg Short Term Municipal Bond ETF | $3.54B | 0.3% | 2.5% | 0.20% | ETF | No |

| VTES | Vanguard Short-Term Tax Exempt Bond ETF | $712M | 0.3% | 2.8% | 0.06% | ETF | No |

| SMB | VanEck Short Muni ETF | $275M | 0.2% | 3% | 0.07% | ETF | No |

Overall, cash has been king for the better part of two years. But now, with risks growing and the Fed potentially making moves, yields on cash are starting to drop. For investors looking to lock in higher income, short-term munis could be an answer. Thanks to their low volatility, high credit quality, and current market-beating after-tax yields, these bonds make an ideal cash substitute for portfolios.

Bottom Line

Cash has been a great asset class over the last few years, but its time in the sun is setting. For those investors still looking for safety and yield, short-term munis could be a great substitute for this allocation. Offering high yields and low volatility, short-term munis are a wonderful choice for conservative investors.